Extreme advancing days you really need to be in before the first hour. The 5min 3/10 macd will be practically useless as well (if you want a good price), so you have to either buy some form of support (vwap, pdh, o/s, etc) and/or go to an even faster time frame for entry cues.

The problem is knowing when you are in an extreme advancing environment before the first hour has traded.

Opening with a 1a criteria (or 4c in the case of an extreme declining day) is my first clue. The extent of the gap involved (there is most often an impulsive gap) and behavior in premarket. Finally, some breadth readings to help you feel like the wind is in your sails.

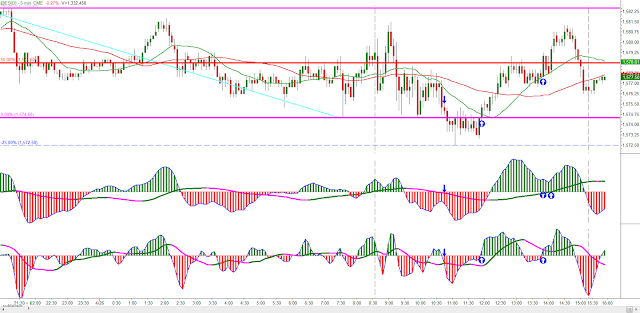

Breadth started strong (TICK opened +1000)

Opening hour- pullback to the Open and vwap coinciding with the pre-market high $157

Lucky exit before the tweet-crash

Volume profile coming into the day, we settled right back into price familiarity

ES_globex. Very interesting that the tweet-crash bounced at the overnight range midpoint, on the dot