Monthly chart of the Dow Transportation Index.

So far looking like a double-top, followed by an attempted re-test that has a rounding look to it (2b criteria often show up at tops).

The setups I include on this blog are used in conjunction with the 3/10macd and the criteria I ascribe to it as a way to alert me to an existing condition of price. The key concept to take away from this blog is that I try to anticipate what will happen on the higher time frame by using a faster time frame to trigger the trade setup. I do not trade a "system" I use two indicators to clue me in to price conditions. Please read the Disclaimer located in the sidebar of this site. I can be contacted via email at toddstrade@gmail.com

I am always open to questions, comments, or suggestions on how to improve this blog.

Saturday, September 29, 2012

Copper 3d

A 3d criteria setup in Copper weekly chart almost completing it's 100% projection. While the daily is currently setting up the 2c-2d criteria

settings

I've been messing with some settings within my charting platform (Tradestation) and trying to determine which to use. There's a setting for building intra-day bars that seems to affect only charts greater than 15-minutes in length. The options are "Natural Hours" and "Session Hours".

Below is what a 130-minute chart looks like using one or the other settings. Of course, a 130-minute bar should only contain 3 bars per day...

It appears as though "Natural Hours" builds the first bar of the day differently than it does the remaining bars.

Below is a 65-minute chart. The "Natural Hours" selection builds a 10-minute bar first, followed by 65-minute bars and ending with a 55-minute bar. Not only that, but the Natural Hours Open is $143.89 while the Session Hours Open is $144.09.

Talking with tech support at Tradestation they explained (though he at first didn't know the difference and seemed to have needed to pull out the manual to find out) something to the effect that each index opens slightly different and so the "Session Hours" may begin with a time, while the "Natural Hours" begin with a first print. I'm going to have to look further into this topic. But if you see a disparity in my charts this is the reason.

Below is what a 130-minute chart looks like using one or the other settings. Of course, a 130-minute bar should only contain 3 bars per day...

It appears as though "Natural Hours" builds the first bar of the day differently than it does the remaining bars.

Below is a 65-minute chart. The "Natural Hours" selection builds a 10-minute bar first, followed by 65-minute bars and ending with a 55-minute bar. Not only that, but the Natural Hours Open is $143.89 while the Session Hours Open is $144.09.

Talking with tech support at Tradestation they explained (though he at first didn't know the difference and seemed to have needed to pull out the manual to find out) something to the effect that each index opens slightly different and so the "Session Hours" may begin with a time, while the "Natural Hours" begin with a first print. I'm going to have to look further into this topic. But if you see a disparity in my charts this is the reason.

Friday, September 28, 2012

Month end

SPY monthly finished 15-cents under a 50% retracement of the monthly high/low range. Momentum is waning and the 3/10macd slow line is approaching zero.

Weekly SPY - anything under $140 in the near term brings to mind the concept of "from failed moves come fast moves".

Weekly SPY - anything under $140 in the near term brings to mind the concept of "from failed moves come fast moves".

Fri. 9/28

SPY with TICK.

Lows were capped by the 25% extension of the overnight range Confluence of the overnight range midpoint, IB_high and o/s_high saw some overshoot (triggered stops perhaps on that move from .26-.56).

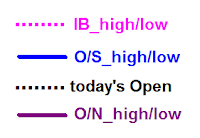

A key for the above chart to define the horizontal lines and dots. For further explanation, see this link:

Advance/Decline rejected at the zero-line

15m/5m with 3/10macd

First entry was taken based on the inverse H&S and 3d criteria on the 5-min chart, otherwise anticipating the 15-min to go to 3a criteria. Actually entered on pullback to the neckline, 1 bar after the up arrow.

Second long was anticipating the ABC 3b-3a continuation move. First short was just a hunch added to the short on second blue down arrow.

15-minute has a Head&Shoulders look to it.

Lows were capped by the 25% extension of the overnight range Confluence of the overnight range midpoint, IB_high and o/s_high saw some overshoot (triggered stops perhaps on that move from .26-.56).

A key for the above chart to define the horizontal lines and dots. For further explanation, see this link:

Advance/Decline rejected at the zero-line

15m/5m with 3/10macd

First entry was taken based on the inverse H&S and 3d criteria on the 5-min chart, otherwise anticipating the 15-min to go to 3a criteria. Actually entered on pullback to the neckline, 1 bar after the up arrow.

Second long was anticipating the ABC 3b-3a continuation move. First short was just a hunch added to the short on second blue down arrow.

15-minute has a Head&Shoulders look to it.

Thursday, September 27, 2012

30min

A 30-minute chart of the SPY with a 20- 50- & 117- period Simple Moving Average. I know, I know, you're thinking; "A 117-SMA is just stupid." However, I use it on a 30-minute chart to closely approximate where the 10-day Moving Average is located. Likewise, the 50-SMA closely approximates (technically 52) where the 5-DAY Simple Moving Average is located.

What is illustrated above is the following:

"BD" means Break Down point. In other words, Price breaks down from previous support pivot.

"T2R" stands for Tries to Recover. In other words, Price tries to recover the Break Down pivot.

Also highlighted is the "3d" criteria on the 3/10macd.

As a reminder, the slow line crossing below (or above) the zero-line often precedes a 20-50 Moving Average crossover (which in the above 30-minute chart approximates the 1.5- & 5- Day Simple Moving Averages, the Green and Blue moving averages).

Also, the "3d" criteria can define areas of important support (later on being resistance).

Just for illustrative purposes, below is a daily (left) and 30-minute chart for comparing the 5- & 10-SMA on the daily with the 52- & 117- SMA on the 30-minute chart.

What is illustrated above is the following:

"BD" means Break Down point. In other words, Price breaks down from previous support pivot.

"T2R" stands for Tries to Recover. In other words, Price tries to recover the Break Down pivot.

Also highlighted is the "3d" criteria on the 3/10macd.

As a reminder, the slow line crossing below (or above) the zero-line often precedes a 20-50 Moving Average crossover (which in the above 30-minute chart approximates the 1.5- & 5- Day Simple Moving Averages, the Green and Blue moving averages).

Also, the "3d" criteria can define areas of important support (later on being resistance).

Just for illustrative purposes, below is a daily (left) and 30-minute chart for comparing the 5- & 10-SMA on the daily with the 52- & 117- SMA on the 30-minute chart.

Thu. 9_27

SPY reclaiming the 20-day MA

SPY with TICK below. Morning selling capped off at the overnight lows. First test of the open swing high was rejected but later broke out from this range.

A key for the above chart to define the horizontal lines and dots. For further explanation, see this link:

Advance/Decline started off strong this morning while the Up/Down volume trended higher all day

15-min and 5-min with 3/10macd below. Slow line back to positive with a breakout of the previous range.

SPY with TICK below. Morning selling capped off at the overnight lows. First test of the open swing high was rejected but later broke out from this range.

A key for the above chart to define the horizontal lines and dots. For further explanation, see this link:

Advance/Decline started off strong this morning while the Up/Down volume trended higher all day

Wednesday, September 26, 2012

Wed. 9_26

Slight continuation of the previous day's momentum.

The overnight low ($143.80) showed two instances of resistance throughout the day. Highlighted areas showing TICK divergences following a high TICK of the day reading.

A key for the above chart to define the horizontal lines and dots. For further explanation, see this link:

Advance/Decline (top) and Up/Down Volume (bottom)

15-min and 5-min with 3/10macd

The overnight low ($143.80) showed two instances of resistance throughout the day. Highlighted areas showing TICK divergences following a high TICK of the day reading.

A key for the above chart to define the horizontal lines and dots. For further explanation, see this link:

Advance/Decline (top) and Up/Down Volume (bottom)

15-min and 5-min with 3/10macd

Tuesday, September 25, 2012

SPY rolled over

An update of an update from this post HERE.

This post originally began as a watch for the 130 min chart setting up a 2c-2d buying opportunity. That buying opportunity never presented itself and has resulted in greater selling pressure.

One could have gotten long yesterday on the break of the seed wave in the middle part of the afternoon and perhaps covered half of the position at the 50% projection just above $146. The subsequent roll-over in price may have resulted in the closing of the remainder position at the original purchase price, or perhaps lower for a loss on the second half of the position.

What's taking place now is the higher time frame (Daily) showing the 2c criteria. We have many of the prerequisite components present; bullish trend development, and higher highs (so far) in price with a lower low in momentum. As discussed before regarding this setup, we want to see the 3d criteria on the faster time frame (130-min chart), or something which resembles an inverse H&S or a strong seed wave.

This post originally began as a watch for the 130 min chart setting up a 2c-2d buying opportunity. That buying opportunity never presented itself and has resulted in greater selling pressure.

One could have gotten long yesterday on the break of the seed wave in the middle part of the afternoon and perhaps covered half of the position at the 50% projection just above $146. The subsequent roll-over in price may have resulted in the closing of the remainder position at the original purchase price, or perhaps lower for a loss on the second half of the position.

What's taking place now is the higher time frame (Daily) showing the 2c criteria. We have many of the prerequisite components present; bullish trend development, and higher highs (so far) in price with a lower low in momentum. As discussed before regarding this setup, we want to see the 3d criteria on the faster time frame (130-min chart), or something which resembles an inverse H&S or a strong seed wave.

Tues. 9_25

The SPY falls apart.

I had to take the following snapshot in two parts because the extension caused the chart to look all squished.

The early morning had an opportunity to squeeze higher, but just couldn't close above the overnight highs of $146.14. Highlighted regions show TICK divergences, but the weakness of the price bars was evidence enough. The 11:00 slight TICK div at the overnight range midpoint is a good example in reading the price bars to determine whether a divergence (and the resulting bounce) is strong or weak.

Later price just deteriorated after losing (and rejecting a re-test of) the overnight lows $145.56. Again, lower price lows on higher TICK readings doesn't mean to buy just because it is a divergence, we have to pay attention to the price bars to gauge strength or weakness.

A key for the above chart to define the horizontal lines and dots. For further explanation, see this link:

Advance/Decline issues essentially trended down all day. It (weakly) tried to bounce at the zero-line but failed, back-tested, then fell apart. The Up/Down volume final reading was the lowest since June.

What cautioned me for potential weakness was how the 15-minute 3/10macd set up. Price showed a 3-push pattern within a channel (bear flag), while the 3/10macd showed this Head & Shoulders type of pattern, which I have just become accustomed to seeing as bearish. Later in the day provided a good example of the 4d-4c continuation criteria (just a bear flag).

I had to take the following snapshot in two parts because the extension caused the chart to look all squished.

The early morning had an opportunity to squeeze higher, but just couldn't close above the overnight highs of $146.14. Highlighted regions show TICK divergences, but the weakness of the price bars was evidence enough. The 11:00 slight TICK div at the overnight range midpoint is a good example in reading the price bars to determine whether a divergence (and the resulting bounce) is strong or weak.

Later price just deteriorated after losing (and rejecting a re-test of) the overnight lows $145.56. Again, lower price lows on higher TICK readings doesn't mean to buy just because it is a divergence, we have to pay attention to the price bars to gauge strength or weakness.

A key for the above chart to define the horizontal lines and dots. For further explanation, see this link:

Advance/Decline issues essentially trended down all day. It (weakly) tried to bounce at the zero-line but failed, back-tested, then fell apart. The Up/Down volume final reading was the lowest since June.

What cautioned me for potential weakness was how the 15-minute 3/10macd set up. Price showed a 3-push pattern within a channel (bear flag), while the 3/10macd showed this Head & Shoulders type of pattern, which I have just become accustomed to seeing as bearish. Later in the day provided a good example of the 4d-4c continuation criteria (just a bear flag).

Monday, September 24, 2012

3rd push

Updating this post HERE.

The SPY has put in a 3rd push lower into the 50SMA on the 130min chart. So, what I'd like to see on the 30-min chart is either a break above $146 or the 3d criteria for a move to the $146 area.

The daily 3/10macd fast line is still pulling back, and in order to anticipate it moving back up we would like to see the faster time frame (130-min in this case) to turn green. A gap up above today's high (were that to happen) could give a morning star reversal pattern on the daily. Under today's lows and things may fall apart.

The SPY has put in a 3rd push lower into the 50SMA on the 130min chart. So, what I'd like to see on the 30-min chart is either a break above $146 or the 3d criteria for a move to the $146 area.

The daily 3/10macd fast line is still pulling back, and in order to anticipate it moving back up we would like to see the faster time frame (130-min in this case) to turn green. A gap up above today's high (were that to happen) could give a morning star reversal pattern on the daily. Under today's lows and things may fall apart.

SPY 9_24

SPY with TICK below..

Area of interest not highlighted includes around the 9:20am point, strong volume on a re-test of the o/s_high.

Worth noting;

High TICK of the day at the o/n_high, followed by a negative TICK divergence.

The midpoint acted as support with a second test showing a low TICK of the day on a higher low in price, followed by a lower low in price and higher low in TICK.

Price tagged a 50% extension of the overnight range which coincided with a gap fill.

A key for the above chart to define the horizontal lines and dots. For further explanation, see this link:

Advancing/Declining issues trended up all day after starting off strongly bearish. Worth noting how the gap fill corresponded with a touch of the zero line on the A/D.

Up/Down volume trended down most of the day with the exception of the mild squeeze mid-afternoon.

SPY 15-min & 5min with 3/10macd. Drawn on the 15-min are two Fib projections; one based on the momentum gap down and pullback, which could have been considered a bear flag, however the selling was capped at the 50% projection. The next projected from the low of the day to the initial swing high and down to the midpoint. Price achieved the 100% projection which corresponded with the 50SMA, a gap fill, and the 50% projection of the o/n_range (as shown in the chart above).

The highlighted region on the 15min indicates the 3d criteria. I took two entries in anticipation of this setup, one around noon and the other about an hour later. The noon long entry I exited with a small loss.

Area of interest not highlighted includes around the 9:20am point, strong volume on a re-test of the o/s_high.

Worth noting;

High TICK of the day at the o/n_high, followed by a negative TICK divergence.

The midpoint acted as support with a second test showing a low TICK of the day on a higher low in price, followed by a lower low in price and higher low in TICK.

Price tagged a 50% extension of the overnight range which coincided with a gap fill.

A key for the above chart to define the horizontal lines and dots. For further explanation, see this link:

Advancing/Declining issues trended up all day after starting off strongly bearish. Worth noting how the gap fill corresponded with a touch of the zero line on the A/D.

Up/Down volume trended down most of the day with the exception of the mild squeeze mid-afternoon.

SPY 15-min & 5min with 3/10macd. Drawn on the 15-min are two Fib projections; one based on the momentum gap down and pullback, which could have been considered a bear flag, however the selling was capped at the 50% projection. The next projected from the low of the day to the initial swing high and down to the midpoint. Price achieved the 100% projection which corresponded with the 50SMA, a gap fill, and the 50% projection of the o/n_range (as shown in the chart above).

The highlighted region on the 15min indicates the 3d criteria. I took two entries in anticipation of this setup, one around noon and the other about an hour later. The noon long entry I exited with a small loss.

Sunday, September 23, 2012

GLD update

GLD is now at the $172 resistance area as mentioned in a previous post HERE.

It would makes sense to see a pullback (though the weekly hasn't printed a necessarily bearish candle yet), and it's in gauging this pullback that will be a clue to a continuation of prior bullish momentum.

It would makes sense to see a pullback (though the weekly hasn't printed a necessarily bearish candle yet), and it's in gauging this pullback that will be a clue to a continuation of prior bullish momentum.

Friday, September 21, 2012

no trigger

I've been posting this potential long setup in the SPY higher time frame over the past few days. Here & Here.

We never did get a trigger entry on the 130min chart, instead price rolled over. Still potential for a 3rd push buying opportunity, which would need to show strong momentum.

Here's how it looked on a slightly faster time frame. Notice how the fast line rolled over on the 30-min chart after giving up $146.

We never did get a trigger entry on the 130min chart, instead price rolled over. Still potential for a 3rd push buying opportunity, which would need to show strong momentum.

Here's how it looked on a slightly faster time frame. Notice how the fast line rolled over on the 30-min chart after giving up $146.

Fri. 9_21

Down-Sideways-Down, is what we ended up with on this OpEx Friday.

Below, SPY with NYSE TICK and volume. Notice the sell-off into the close occurred on a TICK divergence. Just because there is a divergence isn't reason to take (or hold a trade).

A key for the above chart to define the horizontal lines and dots. For further explanation, see this link:

Advancing/Declining issues trended down all day, as did Up/Down volume. The A/D line tried to hold zero, but interesting how up/down volume broke zero and was resisted by it on a pullback.

The 15-min & 5min SPY with 3/10macd. I got chopped around in the mid-afternoon. "Setups" taken (on the 15-min chart) were a 2d-2c continuation (bear flag) early morning, and a 3d "failure" which rolled over out of another bear flag. The long entries taken in the mid afternoon were in anticipation of the 3a criteria, but price was very heavy and couldn't recover the IB_low.

Below, SPY with NYSE TICK and volume. Notice the sell-off into the close occurred on a TICK divergence. Just because there is a divergence isn't reason to take (or hold a trade).

A key for the above chart to define the horizontal lines and dots. For further explanation, see this link:

Advancing/Declining issues trended down all day, as did Up/Down volume. The A/D line tried to hold zero, but interesting how up/down volume broke zero and was resisted by it on a pullback.

The 15-min & 5min SPY with 3/10macd. I got chopped around in the mid-afternoon. "Setups" taken (on the 15-min chart) were a 2d-2c continuation (bear flag) early morning, and a 3d "failure" which rolled over out of another bear flag. The long entries taken in the mid afternoon were in anticipation of the 3a criteria, but price was very heavy and couldn't recover the IB_low.

Thursday, September 20, 2012

thurs. 9_20

SPY with TICK & volume. Significant volume at the lows of the morning (on a + TICK div) as well as on the low TICK of the day at the IB_high. Notice the 1:30-2:30 negative TICK div (perhaps a sign of a small squeeze, forcing shorts to cover)

A key for the above chart to define the horizontal lines and dots. For further explanation, see this link:

Advance/Decline issues trended up all day with price while the Up/Down_volume trended down, but rounded and turned after 1:00pm.

SPY 15m & 5min with 3/10macd below. First up arrow long entry was taken at the prior bar because of the inherent strength. Blue arrows are entries, black arrows are exits.

A key for the above chart to define the horizontal lines and dots. For further explanation, see this link:

Advance/Decline issues trended up all day with price while the Up/Down_volume trended down, but rounded and turned after 1:00pm.

SPY 15m & 5min with 3/10macd below. First up arrow long entry was taken at the prior bar because of the inherent strength. Blue arrows are entries, black arrows are exits.

updated higher t/f

The SPY put in a second push lower today. It's looking like $147.10-147-20 as resistance above and $145.75-146 support below. A move lower (whether a fresh or higher low) could give a decent 3-push setup. Price is still just consolidating after two large momentum moves higher.

While on the daily chart below, we have the 3/10macd fast line pulling into the slow line for the past 3 days. The 130min chart shows the 3/10macd being close to both the fast line and slow line crossing and the fast line about to turn green, which would hint at the higher time frame's (daily chart) fast line turning up.

What is taking place currently on the 130min chart is very similar to what took place on the daily chart back in august. The only difference being here we have a buy divergence on the 130min, while on the daily back in August we had a reverse divergence. However both were/are consolidation phases were price pulled back to a mean before continuing higher.

While on the daily chart below, we have the 3/10macd fast line pulling into the slow line for the past 3 days. The 130min chart shows the 3/10macd being close to both the fast line and slow line crossing and the fast line about to turn green, which would hint at the higher time frame's (daily chart) fast line turning up.

What is taking place currently on the 130min chart is very similar to what took place on the daily chart back in august. The only difference being here we have a buy divergence on the 130min, while on the daily back in August we had a reverse divergence. However both were/are consolidation phases were price pulled back to a mean before continuing higher.

Wednesday, September 19, 2012

higher t_f

SPY higher time frame has some roll-over potential here after failing to generate momentum today in the 2c-2d criteria. Often these failures will see price return back to the down trend line on the faster time frame (drawn in fuchsia). There is still the opportunity for a gap up tomorrow, which could generate some momentum to get over $147.20's. Howe

Subscribe to:

Posts (Atom)