Still within range across the board.

Wide range sideways action since the selloff. Potential short trigger on a down tick in the hourly fast line.

IWM - short trigger on the close

DIA - continues to cycle lower. Again, watch for a down tick in the fast line for a short candidate.

QQQ - The hourly fast line went green (but is below the slow line). Though I wouldn't consider this a long entry if you wanted to be positioned into the weekend with the IWM short trigger it may not have been a bad idea to go long a little QQQ as a small hedge.

The setups I include on this blog are used in conjunction with the 3/10macd and the criteria I ascribe to it as a way to alert me to an existing condition of price. The key concept to take away from this blog is that I try to anticipate what will happen on the higher time frame by using a faster time frame to trigger the trade setup. I do not trade a "system" I use two indicators to clue me in to price conditions. Please read the Disclaimer located in the sidebar of this site. I can be contacted via email at toddstrade@gmail.com

I am always open to questions, comments, or suggestions on how to improve this blog.

Friday, January 31, 2014

01_31

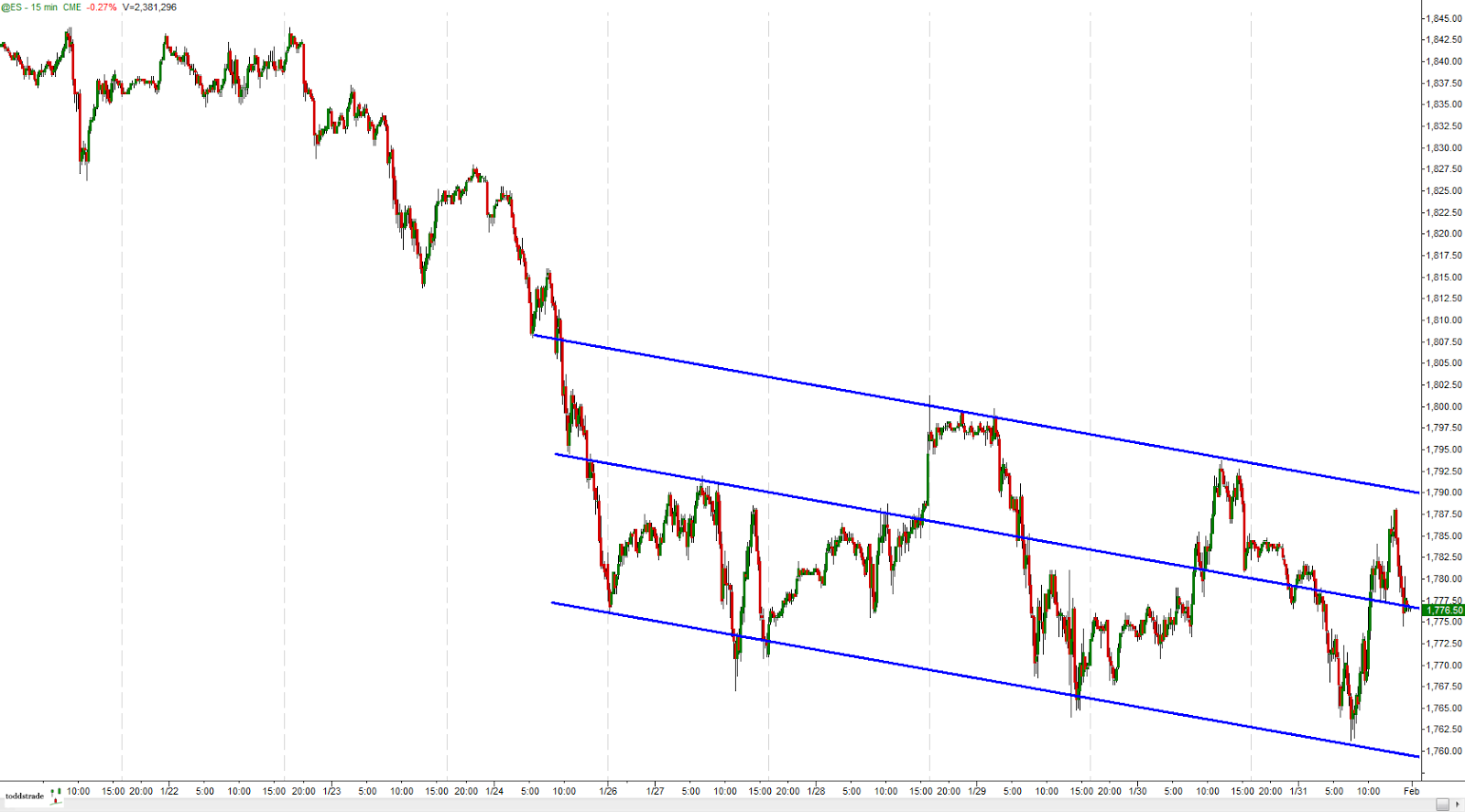

ES

A key for the above (5-min) chart to define the horizontal lines and dots. For further explanation, see this link:

A key for the above (5-min) chart to define the horizontal lines and dots. For further explanation, see this link:

Closed right at the channel midline

Thursday, January 30, 2014

01_30

today's ES

Reached through two extensions of the overnight range. Had you faded the Fib. extensions the two entries would have given an average of 1791.25

A key for the above (5-min) chart to define the horizontal lines and dots. For further explanation, see this link:

Reached through two extensions of the overnight range. Had you faded the Fib. extensions the two entries would have given an average of 1791.25

A key for the above (5-min) chart to define the horizontal lines and dots. For further explanation, see this link:

scratch

Would have taken long positions off for a little better than a scratch. Still bearish on the daily, no need to risk anything.

potential longs

A couple of long entries worth a try on the higher time frame off of a 3d criteria setup on the hourly.

QQQ was the first to trigger a potential entry on the higher time frame. First target 86.95, +$0.55 from entry bar.

SPY

IWM

QQQ was the first to trigger a potential entry on the higher time frame. First target 86.95, +$0.55 from entry bar.

SPY

IWM

Wednesday, January 29, 2014

Wed 01_29

today's ES

A key for the above (5-min) chart to define the horizontal lines and dots. For further explanation, see this link:

Tuesday, January 28, 2014

Monday, January 27, 2014

updated

updates on previous higher time frame index ETFs. Most achieving their third target level.

QQQ

QQQ

DIA

SPY- nearly hit 4R

Mon 01_27

Today's ES

Fading the Fibs would have given you two entries at a 1772 average, decent move back to value following the initial fade.

A key for the above (5-min) chart to define the horizontal lines and dots. For further explanation, see this link:

Fading the Fibs would have given you two entries at a 1772 average, decent move back to value following the initial fade.

A key for the above (5-min) chart to define the horizontal lines and dots. For further explanation, see this link:

Friday, January 24, 2014

Fri 1_24

today's ES

A key for the above (5-min) chart to define the horizontal lines and dots. For further explanation, see this link:

A key for the above (5-min) chart to define the horizontal lines and dots. For further explanation, see this link:

a doozy

Some very strong selling, but in terms of the overall trend this was much needed.

The SPY had a second trigger today, achieving the first target and very nearly reaching the second.

QQQ took a while to unwind, closed right at the primary target ($0.54 as measured from the entry bar)

IWM finally got a trigger to work with and closed right near the primary target

DIA

The SPY had a second trigger today, achieving the first target and very nearly reaching the second.

QQQ took a while to unwind, closed right at the primary target ($0.54 as measured from the entry bar)

IWM finally got a trigger to work with and closed right near the primary target

DIA

as "expected?"

This is exactly the reaction you would want to see with the previously posted weekly IWM pitchfork chart. The Upper Median Line giving resistance.`

zoom in for a closer look; previously the Intermediate pitchfork gave some resistance on initial tests. A larger correction wouldn't be a surprise, the flip side would be an all-out climactic rally outside of the pitchforks.

The QQQ had a similar pullback as it approached the upper median line but broke out weeks later

zoom in for a closer look; previously the Intermediate pitchfork gave some resistance on initial tests. A larger correction wouldn't be a surprise, the flip side would be an all-out climactic rally outside of the pitchforks.

The QQQ had a similar pullback as it approached the upper median line but broke out weeks later

Thursday, January 23, 2014

01_23

Overall, just a minor correction. The DIA and SPY higher time frames had what could have been considered sell triggers and hit their initial/first target. While the QQQ and IWM didn't have what I would consider a short trigger entry.

QQQ pretty much the same story as the IWM

IYT an index worth watching. It continues to plow higher, could be a good "tell" for the other indices.

Came close to hitting a secondary target but had a decent bounce at the 50-day MA

IWM had decent downside momentum but held support. So we'll have to wait to see if it pulls back and continues lower (hourly fast line ticking back down lower) or just blasts higher (fast line going green for a buy)QQQ pretty much the same story as the IWM

IYT an index worth watching. It continues to plow higher, could be a good "tell" for the other indices.

thu 01_23

today's ES

Though it had all the makings of a trend day buyers brought things back above a 50% retrace of the day's range.

Averaging into the Fib. extensions would have seen two entries (nearly three) for an average price of 1820

A key for the above (5-min) chart to define the horizontal lines and dots. For further explanation, see this link:

Though it had all the makings of a trend day buyers brought things back above a 50% retrace of the day's range.

Averaging into the Fib. extensions would have seen two entries (nearly three) for an average price of 1820

A key for the above (5-min) chart to define the horizontal lines and dots. For further explanation, see this link:

Wednesday, January 22, 2014

IWM

Was the only one (out of QQQ, SPY, and DIA) that had a worthwhile entry on the higher time frame. Currently tagged the initial target.

All of the other hourly charts had a negative slow line (4a) and I would rather trade a 2a long as opposed to a 4a.

For example, on the SPY the fast line (hourly, below right) turned positive, but the slow line was still negative. Just not something I would want to enter long, I would prefer to wait for a pullback in that circumstance

All of the other hourly charts had a negative slow line (4a) and I would rather trade a 2a long as opposed to a 4a.

For example, on the SPY the fast line (hourly, below right) turned positive, but the slow line was still negative. Just not something I would want to enter long, I would prefer to wait for a pullback in that circumstance

Sector Performance

Below is the 20-day Sector ETF performance.

XLV, TLT, XLU leading

A key of the symbols if it's hard to decipher

XLV, TLT, XLU leading

Tuesday, January 21, 2014

Tue 01_21

Today's ES - see any 3/10macd triggers? The 'Fib. fade' (averaging into a position at each Fib projection) worked nicely. Would have had you long at two entries for an average of 1828.25 and you would be looking for some sort of mean reversion as an upside target

A key for the above (5-min) chart to define the horizontal lines and dots. For further explanation, see this link:

A key for the above (5-min) chart to define the horizontal lines and dots. For further explanation, see this link:

Monday, January 20, 2014

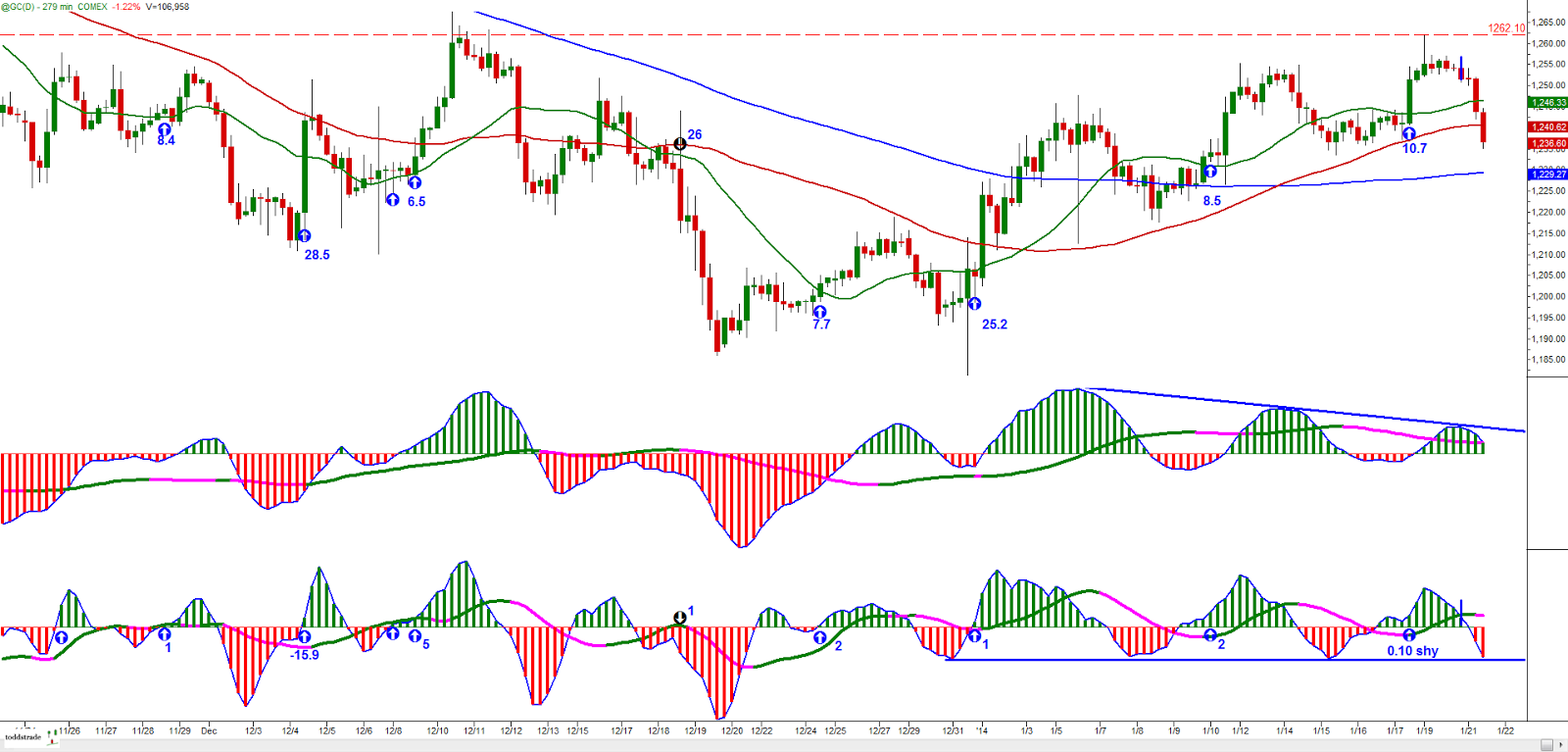

GC

Updated chart from the ones below, to show the fast line/slow line cross providing a warning if long

Actually a bit surprised that Gold continues to squirm higher.

The daily is putting in fairly symmetrical cycles and is at a point where one side will show their hand and we'll see if bulls or bears are stronger here. The bulls have a double-bottom on their side, while the bears have everything else (moving averages, trend lines, and overall trend).

The 4-hour came so close to it's initial target. It still has an opportunity to achieve it, but it can be sketchy holding a position on a fairly late entry so close to resistance (a for sure exit would be the fast line/slow line cross on this time frame's 3/10macd (lower subset indicator).

a better look at the cycles

Actually a bit surprised that Gold continues to squirm higher.

The daily is putting in fairly symmetrical cycles and is at a point where one side will show their hand and we'll see if bulls or bears are stronger here. The bulls have a double-bottom on their side, while the bears have everything else (moving averages, trend lines, and overall trend).

The 4-hour came so close to it's initial target. It still has an opportunity to achieve it, but it can be sketchy holding a position on a fairly late entry so close to resistance (a for sure exit would be the fast line/slow line cross on this time frame's 3/10macd (lower subset indicator).

Subscribe to:

Posts (Atom)