chart dump

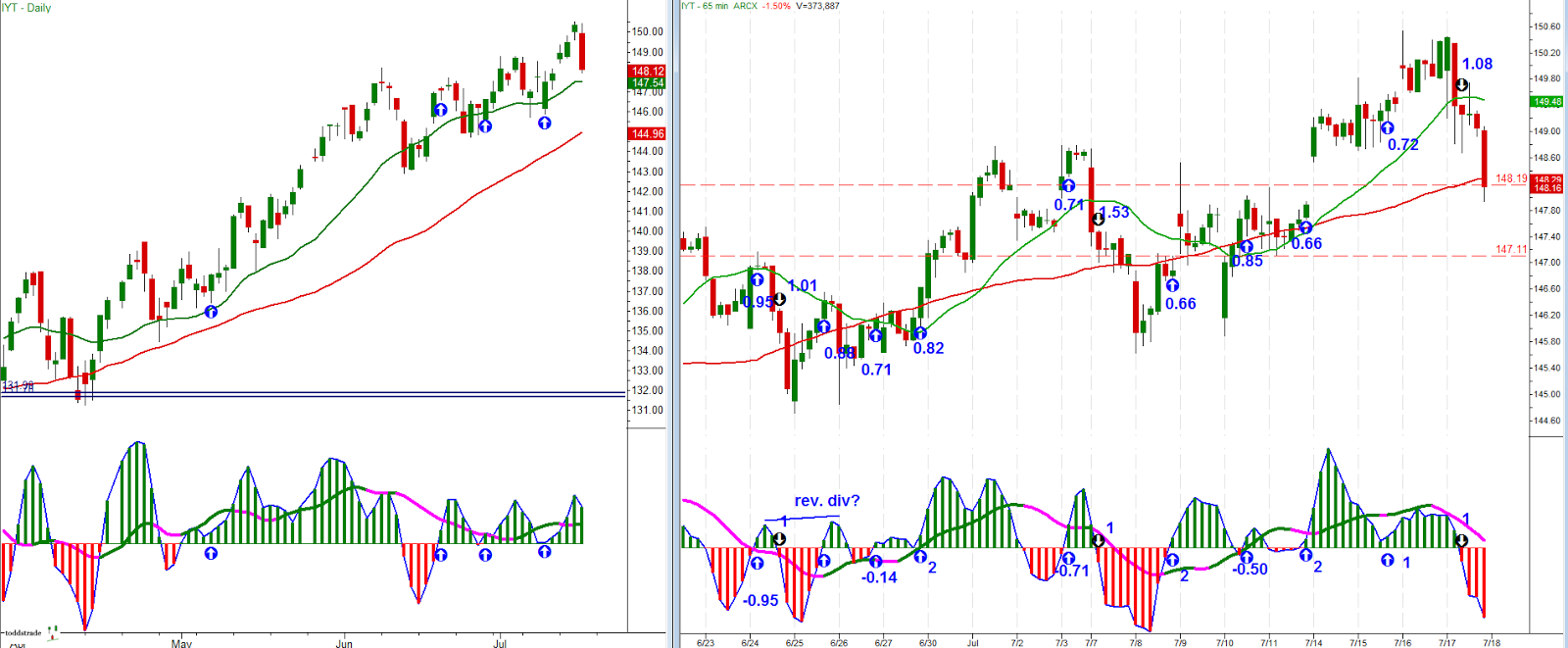

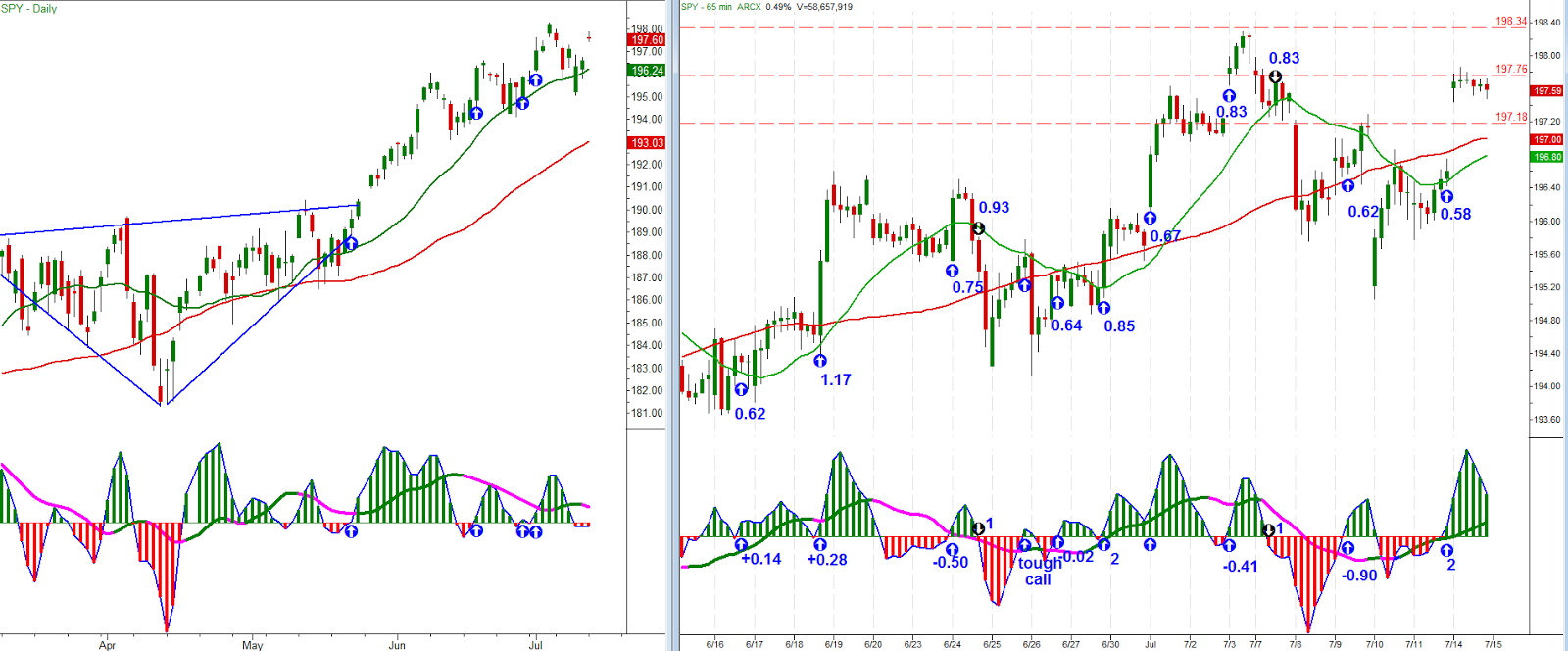

The setups I include on this blog are used in conjunction with the 3/10macd and the criteria I ascribe to it as a way to alert me to an existing condition of price. The key concept to take away from this blog is that I try to anticipate what will happen on the higher time frame by using a faster time frame to trigger the trade setup. I do not trade a "system" I use two indicators to clue me in to price conditions. Please read the Disclaimer located in the sidebar of this site. I can be contacted via email at toddstrade@gmail.com

I am always open to questions, comments, or suggestions on how to improve this blog.

Tuesday, July 29, 2014

Wednesday, July 23, 2014

Tuesday, July 22, 2014

Saturday, July 19, 2014

Thursday, July 17, 2014

Monday, July 14, 2014

Saturday, July 12, 2014

Fri 07_11

Criteria 4a is always a risky long

Most of the index weekly charts show this drooping fast line which I never see as a bullish thing

Curious to see what becomes of the GLD. Currently showing 3d-3a criteria on the higher time frame. It's one of those things that can go either way, but should provide momentum in whichever way it decides.

The monthly looks like it has potential for a break higher, but there is a good deal of overhead resistance. I'm not crazy about how far the slow line is from zero either. So, if long is right it needs to show strong momentum.

Wednesday, July 9, 2014

Subscribe to:

Posts (Atom)