We've been waiting for the 3/10macd fast line and slow line to catch up with one another again, which will probably take place on tomorrow's open. By that time, the move is stretched and one would be buying late into that time frame. So, we need a way to anticipate this potential move by clueing off of a faster time frame.

Here is the Daily (left) 1H (middle) and 15-min time frames

Momentum is in progress, and the only thing to look out for would be lack of follow-through once the first round of selling has occurred. It is Options Expiration week and anything can happen.

Just looking at the higher time frames things are still pretty bullish.

This Daily chart has two macd indicators. The bottom is the standard 3/10-macd that reflects the Daily time frame; the one above it is a macd that reflects a time frame three times slower (closely mimics the weekly 3/10 macd).

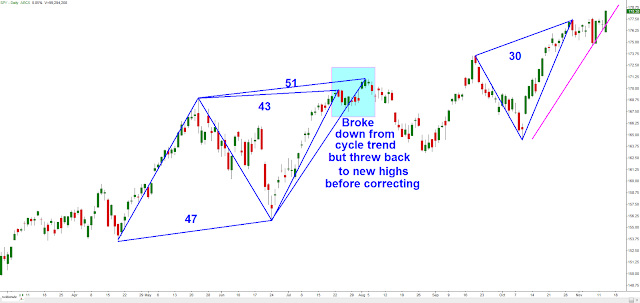

Included are potential entry considerations for the daily time frame. The highlighted regions are indicating like occurrences, in this case, where the fast line was less than the slow line once the fast line turned back up to positive from negative . So the most recent long "triggers" have taken place, but since the fast line is less than the slow line I would look to exit on the daily fast line ticking back down, the way it did in August.