Got beaten up on whatever shorts were held over the weekend

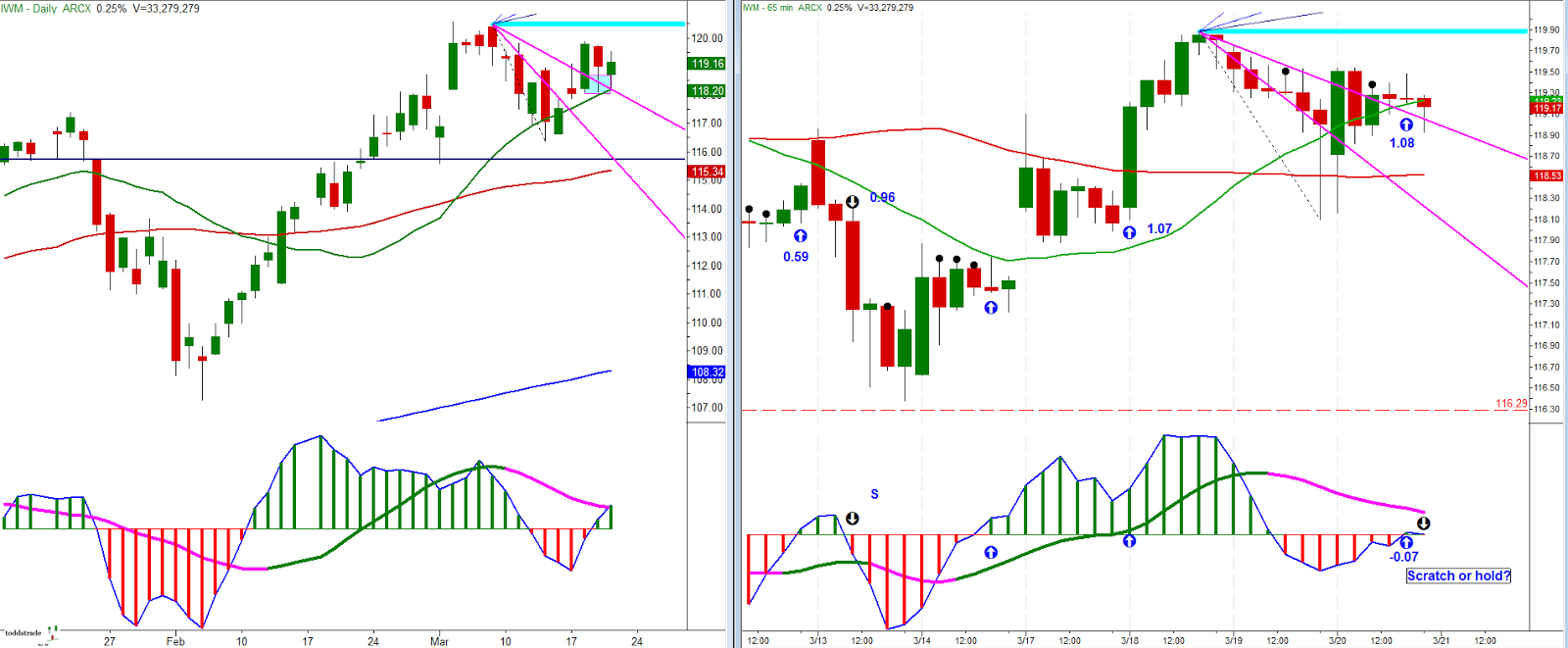

Was able to make some back in IWM

Getting really beaten up in QQQ

DIA - a small scratch on DIA going nowhere beyond the first hour's range

SPY- blah but could turn out breaking from the daily "W" pattern while back above 20-day MA

XLF - meh

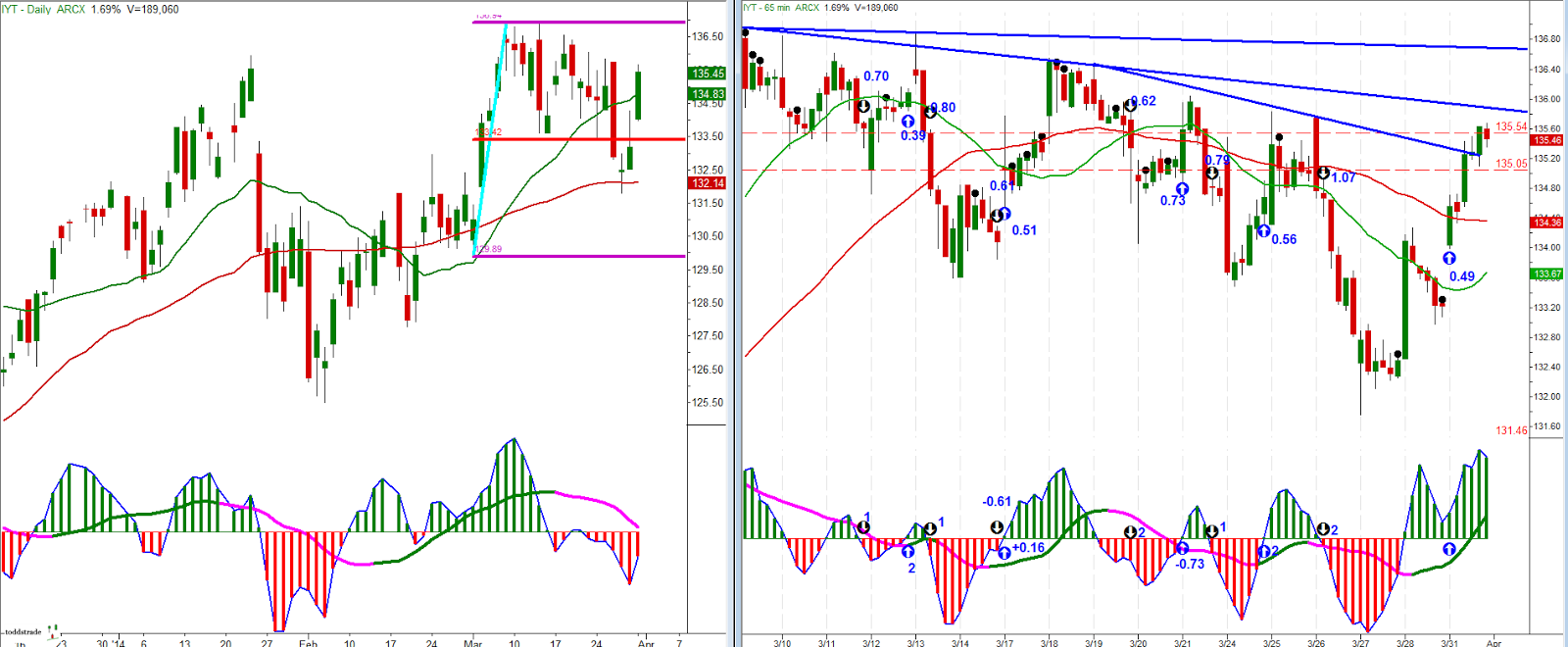

IYT actually a decent day in the transports

The setups I include on this blog are used in conjunction with the 3/10macd and the criteria I ascribe to it as a way to alert me to an existing condition of price. The key concept to take away from this blog is that I try to anticipate what will happen on the higher time frame by using a faster time frame to trigger the trade setup. I do not trade a "system" I use two indicators to clue me in to price conditions. Please read the Disclaimer located in the sidebar of this site. I can be contacted via email at toddstrade@gmail.com

I am always open to questions, comments, or suggestions on how to improve this blog.

Monday, March 31, 2014

Friday, March 28, 2014

Fri 3_28

SPY - Had potential for long follow-through today but it just didn't pan out. It may be tough shorting a negative fast line change on the hourly (being that there would be potential for a 3d criteria) but it will have to be entertained. May be a little inverse H&S developing but there's nothing to trade unless it breaks the neckline.

With a higher time frame look the daily short looks to be worth a try stop at around $164.33 - 164.49 area

QQQ - short trigger within a falling wedge, but a falling wedge can break in either direction

IWM - similar scenario as QQQ

XLF - nothing to report. Important that it holds support after it's recent breakout. May take some time to consolidate if it hods these levels

IYT - 50% retrace was support, now resistance?

EURUSD 4H

ES 4H

Overall we just have to let it coil and play the break

With a higher time frame look the daily short looks to be worth a try stop at around $164.33 - 164.49 area

QQQ - short trigger within a falling wedge, but a falling wedge can break in either direction

IWM - similar scenario as QQQ

XLF - nothing to report. Important that it holds support after it's recent breakout. May take some time to consolidate if it hods these levels

IYT - 50% retrace was support, now resistance?

EURUSD 4H

ES 4H

Overall we just have to let it coil and play the break

Wednesday, March 26, 2014

Wed 03_26

A few indices gave some tough calls in terms of whether I would have/should have taken the trade.

SPY - could have triggered a short on the hourly chart but I didn't like it because it could have been perceived as a 3d criteria and not something I like to short, but being that the daily still has a bearish lean to it it was probably a good R:R trade

DIA - same scenario as with SPY. Notice today is day 14 and price seems to be breaking from the similar congestion pattern as back in January

IWM - gave some clearer bearish setups

QQQ- similar as with SPY & DIA

XLF - in order to play the daily time frame's sell divergence

IYT -

EURUSD - a bit choppy

ES - kind of a late trigger after two small choppy losses

SPY - could have triggered a short on the hourly chart but I didn't like it because it could have been perceived as a 3d criteria and not something I like to short, but being that the daily still has a bearish lean to it it was probably a good R:R trade

DIA - same scenario as with SPY. Notice today is day 14 and price seems to be breaking from the similar congestion pattern as back in January

IWM - gave some clearer bearish setups

QQQ- similar as with SPY & DIA

XLF - in order to play the daily time frame's sell divergence

IYT -

EURUSD - a bit choppy

ES - kind of a late trigger after two small choppy losses

Monday, March 24, 2014

Mon 03_24

Update on primary targets reached.

SPY - extended to a secondary target. The way the Daily is oriented leaves open the potential for a squeeze move higher. Unless it breaks down solidly from $184.50 I am on alert for a move higher.

DIA - bounced solidly off of the primary target. The daily 3/10macd fast line ticked higher so I would be looking to buy a positive fast line change on the hourly.

IWM - hit a tertiary target and yet maintains a hold above support. Double-bottom potential for most indices.

QQQ - secondary target hit, yet would still consider buying a positive fast line change on the hourly

XLF- not much has changed here.

IYT - Had a positive fast line change so may have been worth picking up just to have some long exposure in case of a gap up tomorrow.

EURUSD long potential

ES 4H short trigger; actually wouldn't be surprised if this were stopped out

SPY - extended to a secondary target. The way the Daily is oriented leaves open the potential for a squeeze move higher. Unless it breaks down solidly from $184.50 I am on alert for a move higher.

DIA - bounced solidly off of the primary target. The daily 3/10macd fast line ticked higher so I would be looking to buy a positive fast line change on the hourly.

IWM - hit a tertiary target and yet maintains a hold above support. Double-bottom potential for most indices.

QQQ - secondary target hit, yet would still consider buying a positive fast line change on the hourly

XLF- not much has changed here.

IYT - Had a positive fast line change so may have been worth picking up just to have some long exposure in case of a gap up tomorrow.

EURUSD long potential

ES 4H short trigger; actually wouldn't be surprised if this were stopped out

Friday, March 21, 2014

03_21_OpEx

Well, I didn't see that coming.

Some stop-outs, some triggers, some targets nearly but not quite achieved. Brutal.

SPY- I mentioned yesterday that if price didn't break $188 tomorrow then run for the hills, and that's just what happened. So, one could have managed losses better than what is put forward here, but if you were to adhere to strict rules based on a lagging indicator than the losses listed are a worst-case scenario. In any case, the primary target here came within $0.07 today

Dow - triggered a potential short on the close, will be interesting to see what happens on Monday

QQQ- just fell apart today. Here is an instance where discretionary trading comes into play. Do you take a full stop out, which would have been $0.81 or do you move your stop up to a recent pivot?

At any rate, there are a lot of red candles on the daily chart with a number of lower highs.

IWM - potential trigger on the close

XLF - came within $0.03 of primary target :(

IYT- potential short trigger on the close. Being that the daily 3/10macd has a slow line so far from zero I would be nervous taking this short.

EURUSD didn't reach the primary target, so an exit based on the FL/SL cross seems prudent.

Higher time frame ES with a small loss based on a down-tick of the fast line with consideration to the higher time frame sell divergence (top indicator represents a time frame three-times "slower").

Looking at the weekly SPY doesn't appear all that bearish. However, the weekly 3/10macd fast line has ticked down while the higher time frame macd has a FL<SL. Again, not a bearish trigger, but should encourage a short adverse tolerance for long positions.

Some stop-outs, some triggers, some targets nearly but not quite achieved. Brutal.

SPY- I mentioned yesterday that if price didn't break $188 tomorrow then run for the hills, and that's just what happened. So, one could have managed losses better than what is put forward here, but if you were to adhere to strict rules based on a lagging indicator than the losses listed are a worst-case scenario. In any case, the primary target here came within $0.07 today

Dow - triggered a potential short on the close, will be interesting to see what happens on Monday

QQQ- just fell apart today. Here is an instance where discretionary trading comes into play. Do you take a full stop out, which would have been $0.81 or do you move your stop up to a recent pivot?

At any rate, there are a lot of red candles on the daily chart with a number of lower highs.

IWM - potential trigger on the close

XLF - came within $0.03 of primary target :(

IYT- potential short trigger on the close. Being that the daily 3/10macd has a slow line so far from zero I would be nervous taking this short.

EURUSD didn't reach the primary target, so an exit based on the FL/SL cross seems prudent.

Higher time frame ES with a small loss based on a down-tick of the fast line with consideration to the higher time frame sell divergence (top indicator represents a time frame three-times "slower").

Looking at the weekly SPY doesn't appear all that bearish. However, the weekly 3/10macd fast line has ticked down while the higher time frame macd has a FL<SL. Again, not a bearish trigger, but should encourage a short adverse tolerance for long positions.

Thursday, March 20, 2014

Thu 03_20

A few new triggers. Looks like an impending breakout into OpEx tomorrow.

SPY - fast line didn't tick down on the hourly, so I would still be long. With the daily FL<SL if price doesn't break out above $188 tomorrow I would run for the hills.

QQQ- since the daily FL > SL I would hold on through the next hourly bar instead of scratching it due to the tick down in the hourly fast line.

IWM - could have either scratched it for a small loss and buy if there's a break out tomorrow, or held in anticipation of a breakout tomorrow. Price really needs to get over $119.50 then $120. Doing so will likely be a momentum move which would cause the fast line to tick back up and over the slow line on the hourly chart.

DIA- similar story as with the IWM

IYT - lagging. Could be building an inverted roof type of pattern

XLF - Showing relative strength as everyone is aware. Needs follow-through beyond these highs.

Long triggered on the close for the 4-hour ES, 1884.75 primary target. If this doesn't breakout over 1868, run for zee hills.

EURUSD still working a primary target on the short side (4-hour)

SPY - fast line didn't tick down on the hourly, so I would still be long. With the daily FL<SL if price doesn't break out above $188 tomorrow I would run for the hills.

QQQ- since the daily FL > SL I would hold on through the next hourly bar instead of scratching it due to the tick down in the hourly fast line.

IWM - could have either scratched it for a small loss and buy if there's a break out tomorrow, or held in anticipation of a breakout tomorrow. Price really needs to get over $119.50 then $120. Doing so will likely be a momentum move which would cause the fast line to tick back up and over the slow line on the hourly chart.

DIA- similar story as with the IWM

IYT - lagging. Could be building an inverted roof type of pattern

XLF - Showing relative strength as everyone is aware. Needs follow-through beyond these highs.

Long triggered on the close for the 4-hour ES, 1884.75 primary target. If this doesn't breakout over 1868, run for zee hills.

EURUSD still working a primary target on the short side (4-hour)

Wednesday, March 19, 2014

Wed 03_19

No new triggers and things can really go either way from here; either we tick back lower giving us an XYZ wave or we gap up and squeeze higher.

IWM held it's 50% retrace firmly. $119.90 above and $118 below

QQQ- basically the lines in the sand for above are today's highs and for below are the 50% retraces

SPY -

DIA - daily illustrating the potential for the XYZ wave on the 3/10macd which would require a breakdown of support

IWM held it's 50% retrace firmly. $119.90 above and $118 below

QQQ- basically the lines in the sand for above are today's highs and for below are the 50% retraces

SPY -

DIA - daily illustrating the potential for the XYZ wave on the 3/10macd which would require a breakdown of support

Subscribe to:

Posts (Atom)