A few new triggers. Looks like an impending breakout into OpEx tomorrow.

SPY - fast line didn't tick down on the hourly, so I would still be long. With the daily FL<SL if price doesn't break out above $188 tomorrow I would run for the hills.

QQQ- since the daily FL > SL I would hold on through the next hourly bar instead of scratching it due to the tick down in the hourly fast line.

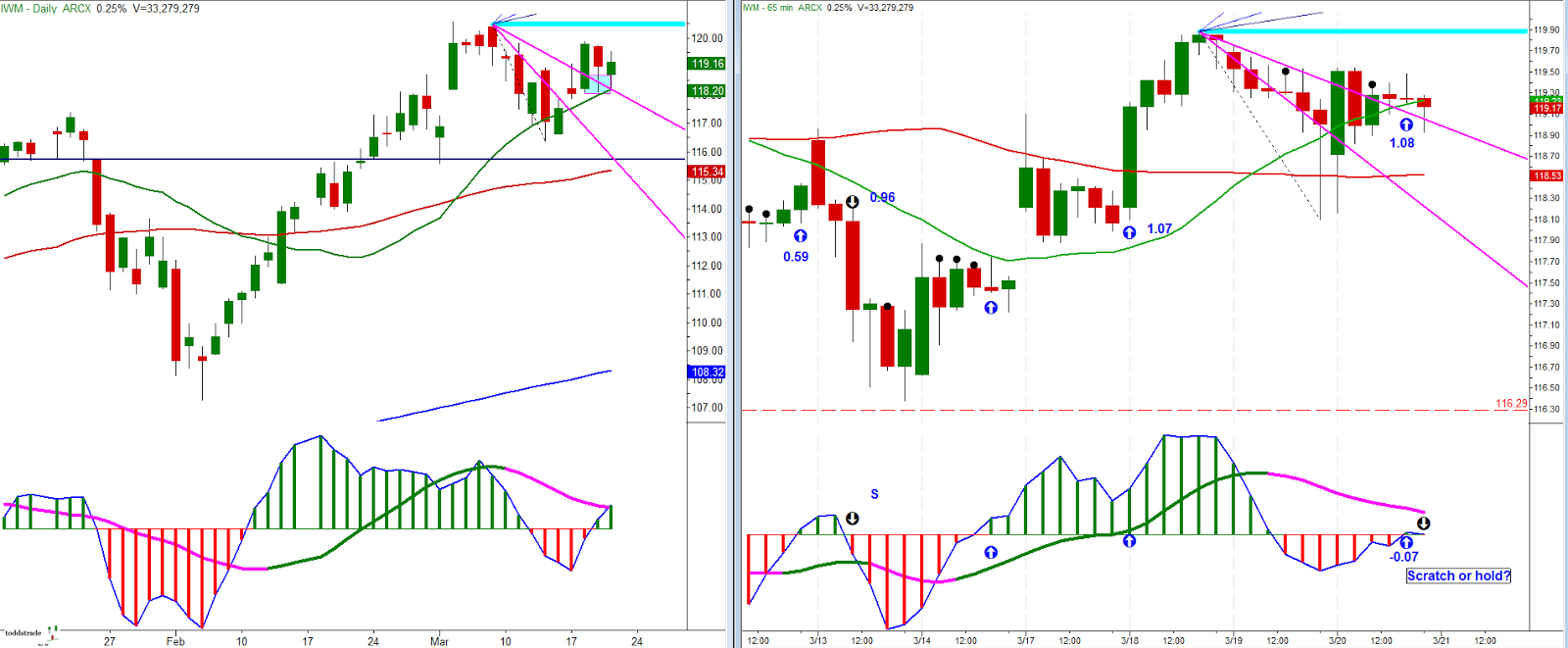

IWM - could have either scratched it for a small loss and buy if there's a break out tomorrow, or held in anticipation of a breakout tomorrow. Price really needs to get over $119.50 then $120. Doing so will likely be a momentum move which would cause the fast line to tick back up and over the slow line on the hourly chart.

DIA- similar story as with the IWM

IYT - lagging. Could be building an inverted roof type of pattern

XLF - Showing relative strength as everyone is aware. Needs follow-through beyond these highs.

Long triggered on the close for the 4-hour ES, 1884.75 primary target. If this doesn't breakout over 1868, run for zee hills.

EURUSD still working a primary target on the short side (4-hour)

The setups I include on this blog are used in conjunction with the 3/10macd and the criteria I ascribe to it as a way to alert me to an existing condition of price. The key concept to take away from this blog is that I try to anticipate what will happen on the higher time frame by using a faster time frame to trigger the trade setup. I do not trade a "system" I use two indicators to clue me in to price conditions. Please read the Disclaimer located in the sidebar of this site. I can be contacted via email at toddstrade@gmail.com

I am always open to questions, comments, or suggestions on how to improve this blog.

No comments:

Post a Comment