Gold has been oscillating around it's midpoint for 18 months now.

The setups I include on this blog are used in conjunction with the 3/10macd and the criteria I ascribe to it as a way to alert me to an existing condition of price. The key concept to take away from this blog is that I try to anticipate what will happen on the higher time frame by using a faster time frame to trigger the trade setup. I do not trade a "system" I use two indicators to clue me in to price conditions. Please read the Disclaimer located in the sidebar of this site. I can be contacted via email at toddstrade@gmail.com

I am always open to questions, comments, or suggestions on how to improve this blog.

Saturday, December 20, 2014

previous post

trigger; positive fast line on weekly time frame in order to anticipate the higher (monthly) time frame setting up a 3d criteria long setup. $54.30 stop seems wide but it is a larger time frame. I'm not a fan of the setup being that it's a red candle in a predominantly bear trend, but you have to wait it out and gauge momentum.

Gold has been oscillating around it's midpoint for 18 months now.

Gold has been oscillating around it's midpoint for 18 months now.

Thursday, December 4, 2014

GC monthly

Potential 3d criteria setup on the GC monthly time frame. Looking for the weekly fast line to turn positive.

long-term DXY

Quarterly chart of the U.S.Dollar Index going back to the 1970's. Provided the gains hold through the end of the year we could be witness to a breakout on a very long-term time frame.

Monday, October 27, 2014

Copper 3d setup

3d criteria setup on the HG daily time frame.

Primary target is back to previous resistance and through the daily 50-day MA ($3.1055).

updated

Primary target is back to previous resistance and through the daily 50-day MA ($3.1055).

updated

Saturday, October 18, 2014

Monday, October 13, 2014

Mon 10_13

Lowest selling momentum since 2012. Trend intact. Coming in to support. $182, $177, $169. $192 above.

'3d' criteria setup on $GC Daily time frame. Initial target 1245.50. $1273 above big supply zone.

Monthly potential for 3d criteria setup (would need to see the weekly fast line turn positive).

$CL_F

Largest daily negative momentum since Jan 2014 at a 'double-bottom' point. $81.50 at lower edge. $90 first above.

Wednesday, August 27, 2014

Andrews Median Line

Interesting pitchfork confluence in some issues.

SPY sitting at upper median line

XLF - been riding the lower median line for quite a while, now throwing back

IWM - two failures to break UML

QQQ - on a strong trajectory

DIA - 3 successful bounces at lower median line

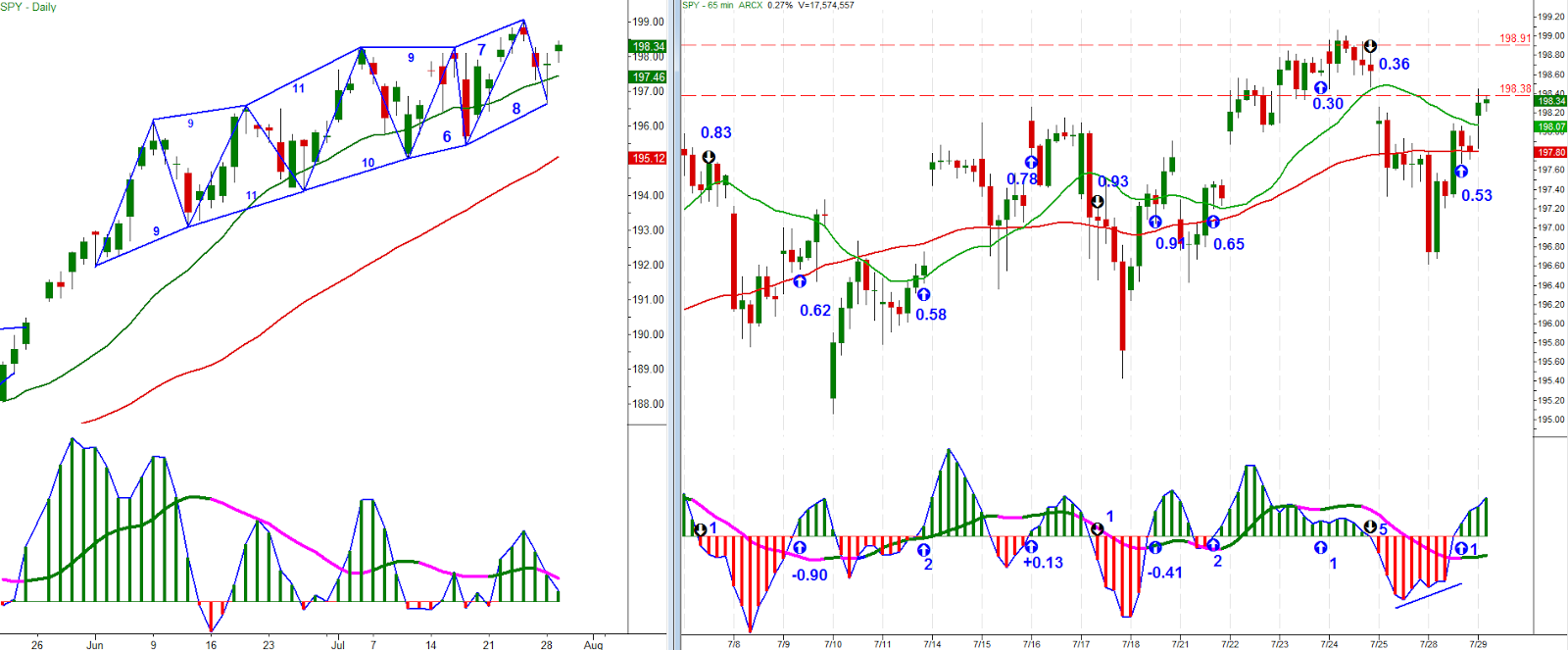

Here's an updated look at the SPY cycle count

Dow Jones Quarterly long term

SPY sitting at upper median line

XLF - been riding the lower median line for quite a while, now throwing back

IWM - two failures to break UML

QQQ - on a strong trajectory

DIA - 3 successful bounces at lower median line

Here's an updated look at the SPY cycle count

Dow Jones Quarterly long term

Saturday, August 16, 2014

Nothing has really changed.

SPY - weekly with a 3x higher time frame overlay. Higher time frame fast line has crossed below slow line (price can still move higher). The trend is still viewed as strong and each test of the 20-week MA has been bought.

IWM - still negative for the year

weekly - either way it breaks there is pressure building. M-top or it can break higher like all markets have done since 2012. Looks like a $12 measured move though.

QQQ - beast mode

SPY - weekly with a 3x higher time frame overlay. Higher time frame fast line has crossed below slow line (price can still move higher). The trend is still viewed as strong and each test of the 20-week MA has been bought.

IWM - still negative for the year

weekly - either way it breaks there is pressure building. M-top or it can break higher like all markets have done since 2012. Looks like a $12 measured move though.

QQQ - beast mode

Tuesday, August 12, 2014

Saturday, August 9, 2014

Friday, August 1, 2014

Thu 07_31

SPY - break away gap after symmetrical cycle consolidation

DIA - back to the start of 2014

QQQ -

IWM - three pushes to a low?

XLF -

IYT - reverse divergence building, should have a strong bounce

NYSE 52-week High/Low differential. Most recent negative readings resulted in a bounce, otherwise it has often marked steeper corrections.

McClellan oscillator lowest in quite some time

Tuesday, July 29, 2014

Subscribe to:

Posts (Atom)