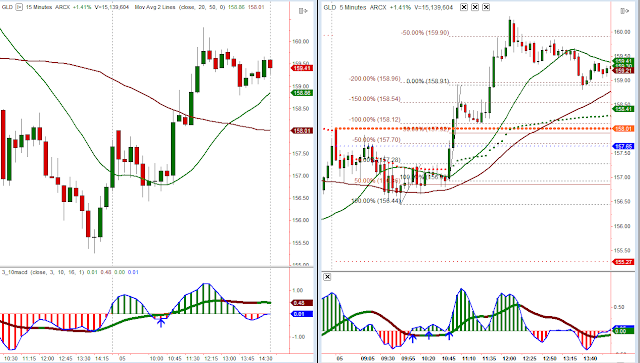

A 3d long entry I missed today in the GLD

Long entry in CVX. Exited the majority of the position at the close of the bar at the down arrow, held a small position as a swing trade based on the higher time frame.

I went long FAZ based on the 3d criteria, but taken in perspective with the broad market after getting stopped-out (lost $0.60/share) I went short (there were actually shares to borrow!). I mentioned the other day that when a 3d long setup fails, it is usually profitable to reverse the trade. Exited the majority of the position at the 200% projection ($4/share) and held a small position overnight.

The setups I include on this blog are used in conjunction with the 3/10macd and the criteria I ascribe to it as a way to alert me to an existing condition of price. The key concept to take away from this blog is that I try to anticipate what will happen on the higher time frame by using a faster time frame to trigger the trade setup. I do not trade a "system" I use two indicators to clue me in to price conditions. Please read the Disclaimer located in the sidebar of this site. I can be contacted via email at toddstrade@gmail.com

I am always open to questions, comments, or suggestions on how to improve this blog.

No comments:

Post a Comment