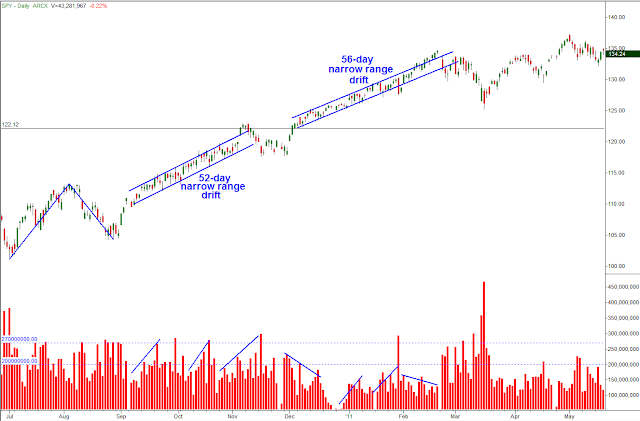

A look at the SPY from September through November of 2010 compared to now:

Proof that volume is not necessarily a required component for higher prices? Though there was higher volume in the 2010 period it just doesn't seem to matter at this point; shorts are learning their lesson and becoming more timid while long positions are not being liquidated.

The narrow drifting price range of 2010 then replicated itself (measured move?) going in to the beginning months of 2011. Again, volume on the selling but price drifts back to highs.

The volatile corrections have increased in volume and in the time it takes for price to stabilize.

The January-March 2010 period had a 30-day corrective cycle with 61-days between the bottom and the next sell-off (1:2 ratio).

The May-September 2010 period had a 97-day corrective period with 283-days between it's low and the next sell-off (1:3 ratio).

No comments:

Post a Comment