First off, coming into this morning we had some divergences showing up with evidence of buying at the lows in the pre-market. The selling at the 9:00am hour led to lower lows but also set up the 3d criteria. Often times I look for an inverse Head & Shoulders pattern with the 3d, but a lower low is just as valid because in that situation you have 3-pushes to a low that results in a short covering move. Here's a look at the charts which include pre-market data:

The triggers in the above 3d setup (two sets of up-arrows) weren't stellar but strops weren't triggered, best entries were at the 50% retrace. Also, the 50% projection was achieved but the 100% percent target was capped off by the pre-market supply zone (dash line of the Fib. fan on the 15-min chart).

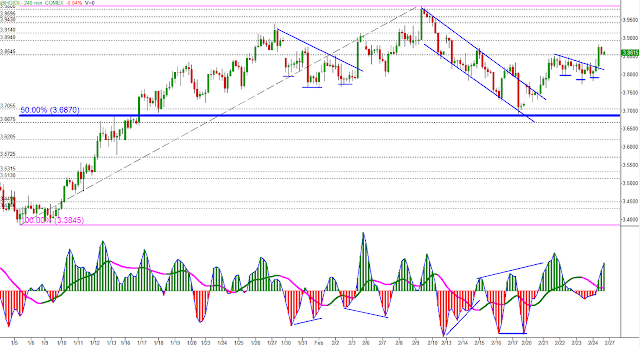

Here's an updated chart of the one above to include the after hours market, where price finally reached the Fib. fan extension based off of the pre-market

Now some setups.

Two examples of the 2c-2d long setup; One bad, one good, see if you could tell what characteristic exists that makes one a better setup over the other:

First, BIDU. I missed the first trigger (first up arrow) but entered at the 50% projection with a target of the 100% projection for a quick 80-cents. I included the second trigger (second up-arrow) to show the extent which discretion plays in these setups. Just because it can be perceived as a trigger doesn't mean I'll take it, especially if price is extended, most of the targets were reached, and/or of it's an overall bearish day.

Second, NFLX. I was quickly stopped out of this trade, however, had I used the correct stop placement I would have remained in the trade (I typically use an ATR on the 5-min chart to give me stop placement, the ATR at the time of entry was 65-cents and I put in a 50-cent stop which was triggered. Irregardless, I would have likely taken a loss either way).

So, you can probably tell that the main difference between the two 2c-2d setups is the strength (or lack) of trend. It's always preferable to find setups which have a prevailing trend.

Here was another 2c-2d setup in V. Using a 30-minute chart. I missed the first triggered entry but took the second. Also left a decent amount on the table by taking profits at the 50% & 100% projections.

Finally, a late afternoon trade in BIDU again. Exits again at 50% & near the 100% projections. I was actually holding out for the $137.40 price (dash line of the Fib. Fan) but the high was at 137.37.