The Dow is still under it's previous swing highs (perhaps the one thing preventing this market from really taking off)

Transports have been chugging along, closing just under the selling wick of Tuesday

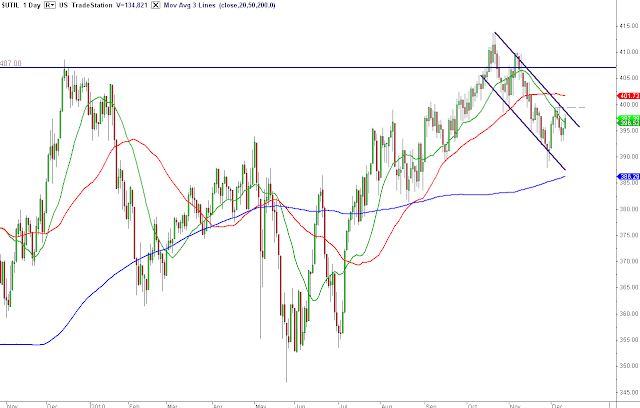

The Utilities however, are in the process of pulling back from a test of previous swing highs:

There's something within Dow Theory regarding the agreement of these three components (Industrials, Transports, Utilities), so it's curious to see how it will all play out.

The laggard (Utilities) is within the top portion of a down-sloping channel, where it looks to be at a potential breakout point

Price has made a little hook (seed wave) these past few days, which could trigger a long entry, but how much resistance the overhead 50-day MA puts up will be very telling as to whether these 3 components begin to gel.

The setups I include on this blog are used in conjunction with the 3/10macd and the criteria I ascribe to it as a way to alert me to an existing condition of price. The key concept to take away from this blog is that I try to anticipate what will happen on the higher time frame by using a faster time frame to trigger the trade setup. I do not trade a "system" I use two indicators to clue me in to price conditions. Please read the Disclaimer located in the sidebar of this site. I can be contacted via email at toddstrade@gmail.com

I am always open to questions, comments, or suggestions on how to improve this blog.

No comments:

Post a Comment