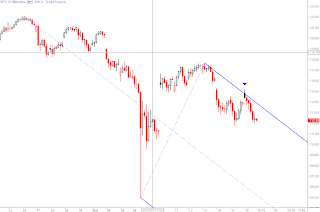

A lot of overhead supply in this market. It seems we gear up for a "healthy" bounce only to get caught up in thickets of supply.

{updated chart}

{updated chart}

Though that Euro issue just doesn't seem to be going away...

{updated chart}

{updated chart}

However, bottoms don't happen in a day. Currently there is a potential inverse Head & Shoulders pattern here...

{updated chart}

{updated chart}

looking for buying interest between here and 1060. Any lower and I would suspect a move beyond the recent lows.

Looking back at February's sell off you can see how much energy goes into a bottoming process.

On the way down, rallies are held cautiously and selloffs are taken aggressively, continuing a lower low/lower high profile.

On the way up, rallies are held cautiously and selloffs taken aggressively, causing a shift to higher highs/higher lows. In the process, consolidation ranges build up (acceptance of price) until a break out/down occurs.

Daily chart with potential resistance near-term:

Daily chart with potential resistance near-term: POT

POT 30-min

30-min FCX has moved nearly 10% in 3 days...me thinks it could consolidate in that$73-$74 range:

FCX has moved nearly 10% in 3 days...me thinks it could consolidate in that$73-$74 range: