Well, I wasn't about to go long and hold a basket of miner/metal/commodity names overnight, but it was a good strategy that paid off, and I noticed a good amount of people on twitter doing that very thing. What follows is number of the charts that I saw setting up into the close, all of which being the 3d setup.

USO - triggered on the close, opened with a squeeze back to previous support.

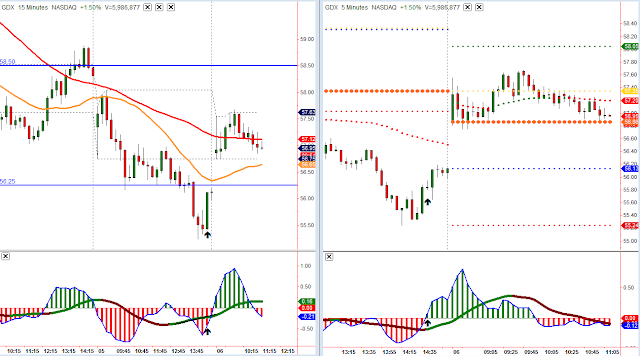

GDX - triggered on the close and popped up on the open.

FCX - The first 3d setup may have resulted in a stop-out, the second entry into the close led to a wide gap up on the open into the previous days value area.

CNX - similar setups as FCX

CDE - set up into the open and provided a good pullback long in the morning

ANR - Notice a recurring theme?

GLD -

SLV - The slow line didn't have as stable a slope/trend as the previous examples, but the trigger worked while the pennant pullback on the open gave a good entry point.

The setups I include on this blog are used in conjunction with the 3/10macd and the criteria I ascribe to it as a way to alert me to an existing condition of price. The key concept to take away from this blog is that I try to anticipate what will happen on the higher time frame by using a faster time frame to trigger the trade setup. I do not trade a "system" I use two indicators to clue me in to price conditions. Please read the Disclaimer located in the sidebar of this site. I can be contacted via email at toddstrade@gmail.com

I am always open to questions, comments, or suggestions on how to improve this blog.

No comments:

Post a Comment