It has been a seemingly rough weeks for Copper, but under the surface it has been very constructive.

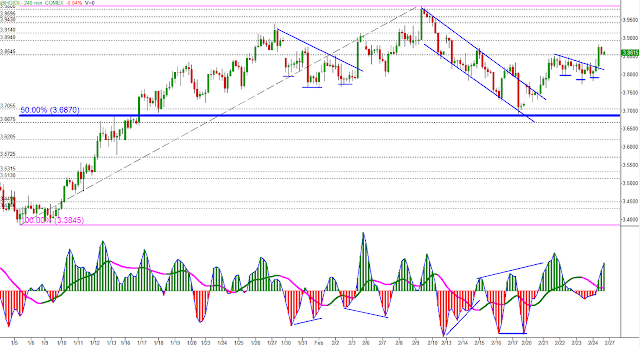

Price was still unable to recover that trendline (neckline) which it broke down from last week, but perhaps next week we'll see some resolution to that. Price managed to close above the daily 20-period Moving Average on Friday's close.

The weekly time frame finished with a strong inside bar, constructively consolidating under the September 2011 breakdown point and regaining that $3.76 mark which has shown to be a prior resistance/support level.

Looking a bit closer we can see that the recent selling almost made it to the 50% retracement of our previous breakout momentum, an encouraging sign for bullish potential.

Looking for at least a test of the $3.99's over the next week or so.

The setups I include on this blog are used in conjunction with the 3/10macd and the criteria I ascribe to it as a way to alert me to an existing condition of price. The key concept to take away from this blog is that I try to anticipate what will happen on the higher time frame by using a faster time frame to trigger the trade setup. I do not trade a "system" I use two indicators to clue me in to price conditions. Please read the Disclaimer located in the sidebar of this site. I can be contacted via email at toddstrade@gmail.com

I am always open to questions, comments, or suggestions on how to improve this blog.

1 comment:

Nice post.

Post a Comment