Some updates after yesterday's fiasco. At least some losses would have be recoupable. A couple potential long entries, but most are a tough call whether to enter or wait to see if it pulls back before continuation.

The setups I include on this blog are used in conjunction with the 3/10macd and the criteria I ascribe to it as a way to alert me to an existing condition of price. The key concept to take away from this blog is that I try to anticipate what will happen on the higher time frame by using a faster time frame to trigger the trade setup. I do not trade a "system" I use two indicators to clue me in to price conditions. Please read the Disclaimer located in the sidebar of this site. I can be contacted via email at toddstrade@gmail.com

I am always open to questions, comments, or suggestions on how to improve this blog.

Wednesday, June 25, 2014

Tuesday, June 24, 2014

Friday, June 13, 2014

Thursday, June 12, 2014

thu 6_12

SPY - daily 20- & 50-MA's are bullish, but the FL is now < SL so there could be a 1b-1a move but it will take the hourly a bit of time to rearrange bullish for a entry on that anticipation.

DIA -still riding the trend, same story as SPY

QQQ - stretched

IWM - will be most curious to see how well this holds onto recent momentum

XLF - bullish corrective

IYT - still bullish, but seeing that 2c criteria (daily) and the fact that the FL & SL are so far apart it seems like it will take a while before this re-orients bullish.

ES 4h

DIA -still riding the trend, same story as SPY

QQQ - stretched

IWM - will be most curious to see how well this holds onto recent momentum

XLF - bullish corrective

IYT - still bullish, but seeing that 2c criteria (daily) and the fact that the FL & SL are so far apart it seems like it will take a while before this re-orients bullish.

ES 4h

Saturday, June 7, 2014

weekly

A few primary targets hit on the weekly time frames.

SPY - hit on Friday. Expecting the higher time frame (upper indicator) to see a FL/SL cross on next week's close. As mentioned many times before; just because the FL < SL on the traded time frame (upper most macd) doesn't mean price can't go higher, and when the FL finally does cross the slow line it can be too late in the move (which is why you use the faster time frame (lower 3/10macd) to time an anticipated trade in the direction of that higher, traded, time frame.

DIA - depending upon discretion you could have either stayed in this triggered trade or gotten out because of the 3/10macd fast line ticking lower. Also, depending upon discretion, you could have entertained the idea of entering long on the close of this week with the fast line ticking up, but it's not really a setup I like to chase.

QQQ - reached it's primary target on very strong momentum.

IWM - actually triggered on the close Friday for a primary target back to the all-time highs

XLF - nearing a primary target, all while the higher time frame has a FL < SL and seemingly waning momentum

IYT - been leading with shorter-term consolidations prior to breakouts

ES - like the SPY reached a primary target on Friday

SPY - hit on Friday. Expecting the higher time frame (upper indicator) to see a FL/SL cross on next week's close. As mentioned many times before; just because the FL < SL on the traded time frame (upper most macd) doesn't mean price can't go higher, and when the FL finally does cross the slow line it can be too late in the move (which is why you use the faster time frame (lower 3/10macd) to time an anticipated trade in the direction of that higher, traded, time frame.

DIA - depending upon discretion you could have either stayed in this triggered trade or gotten out because of the 3/10macd fast line ticking lower. Also, depending upon discretion, you could have entertained the idea of entering long on the close of this week with the fast line ticking up, but it's not really a setup I like to chase.

QQQ - reached it's primary target on very strong momentum.

IWM - actually triggered on the close Friday for a primary target back to the all-time highs

XLF - nearing a primary target, all while the higher time frame has a FL < SL and seemingly waning momentum

IYT - been leading with shorter-term consolidations prior to breakouts

ES - like the SPY reached a primary target on Friday

Wednesday, June 4, 2014

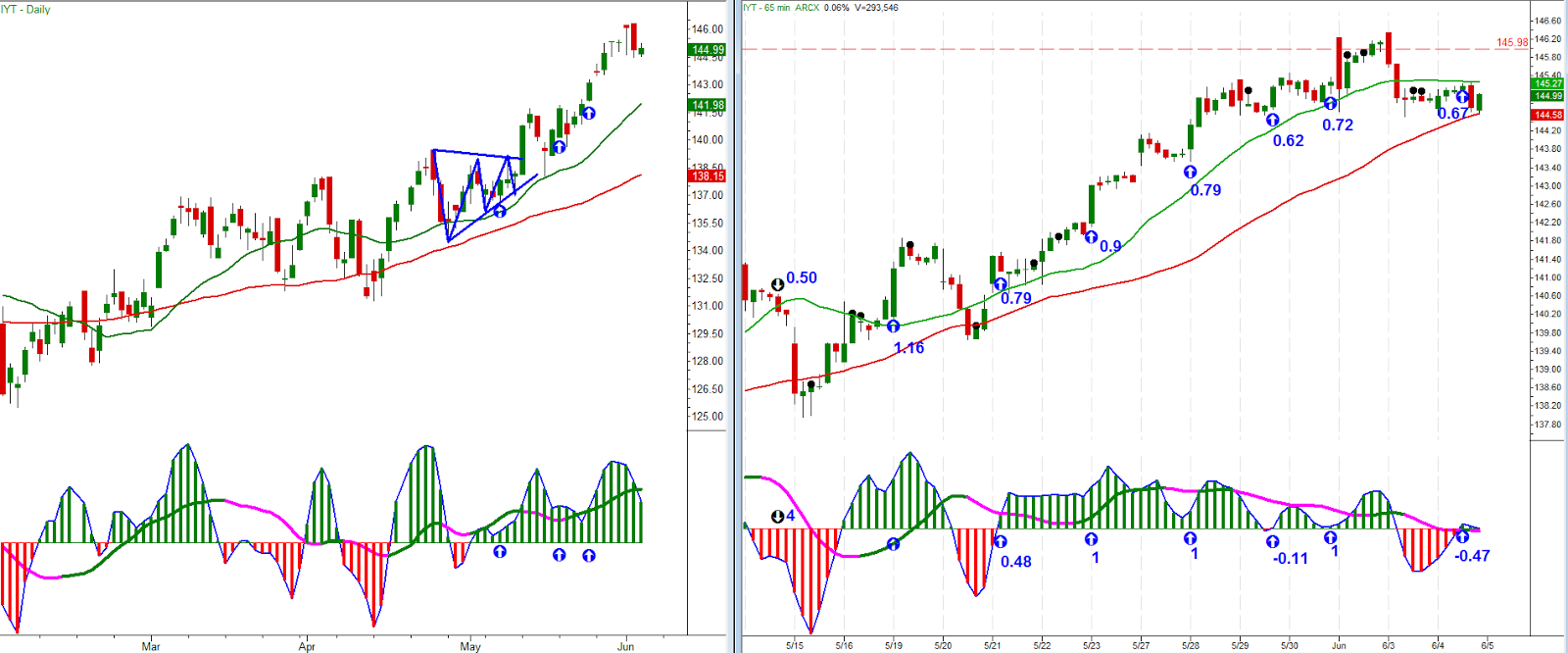

Wed. 06_04

SPY - within $0.07 of primary target

DIA - Lower high or base to break?

QQQ - $0.05 from primary. Kind of discretionary if the desire to hold.

IWM - possibly the tell for the next few days?

XLF - trending along the hourly 20-period MA

IYT - small H&S on the hourly with a MM target to about 142.66 area

@ES 4h - higher time frame macd FL < SL, primary target 7-points away

@ES weekly - FL<SL on the higher time frame, primary target 20-points away, price continues to ride the 20-period MA

Subscribe to:

Comments (Atom)