ES w/ globex

The setups I include on this blog are used in conjunction with the 3/10macd and the criteria I ascribe to it as a way to alert me to an existing condition of price. The key concept to take away from this blog is that I try to anticipate what will happen on the higher time frame by using a faster time frame to trigger the trade setup. I do not trade a "system" I use two indicators to clue me in to price conditions. Please read the Disclaimer located in the sidebar of this site. I can be contacted via email at toddstrade@gmail.com

I am always open to questions, comments, or suggestions on how to improve this blog.

Thursday, August 29, 2013

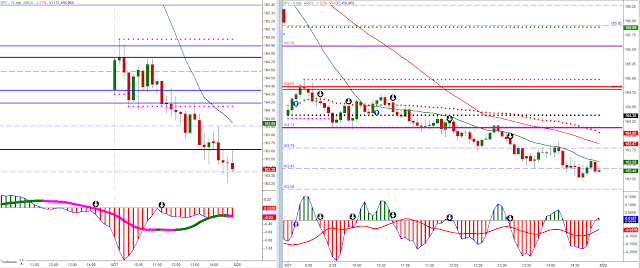

Thu 08_29

A key for the above (5min) chart to define the horizontal lines and dots. For further explanation, see this link:

Wednesday, August 28, 2013

Wed. 08_28

A key for the above (5min) chart to define the horizontal lines and dots. For further explanation, see this link:

ES w/ globex

Tuesday, August 27, 2013

Tue 08_27

A key for the above (5min) chart to define the horizontal lines and dots. For further explanation, see this link:

ES w/ globex

Monday, August 26, 2013

Mon 08_26

A key for the above (5min) chart to define the horizontal lines and dots. For further explanation, see this link:

ES w/ globex

Friday, August 23, 2013

Fri 08_23

A key for the above (5min) chart to define the horizontal lines and dots. For further explanation, see this link:

ES w/ globex

Thursday, August 22, 2013

thu 08_22

A key for the above (5min) chart to define the horizontal lines and dots. For further explanation, see this link:

ES w/ globex

Wednesday, August 21, 2013

Wed 08_21

A key for the above (5min) chart to define the horizontal lines and dots. For further explanation, see this link:

ES w/ globex; Very choppy open

Tuesday, August 20, 2013

Tue 08_20

A key for the above (5min) chart to define the horizontal lines and dots. For further explanation, see this link:

ES w/ globex

ES w/ globex

should have

Re: a previous chart posted for Gold, I should have included 1384.70 as a small pivot (missed it by $0.60 yesterday). 1351.60 (to the penny) saw buying interest overnight.

Monday, August 19, 2013

Mon 08_19

A key for the above (5min) chart to define the horizontal lines and dots. For further explanation, see this link:

If there are arrows on the higher time frame chart (left) they indicate anticipatory trades that are entered using the faster time frame.

ES w. globex

If there are arrows on the higher time frame chart (left) they indicate anticipatory trades that are entered using the faster time frame.

ES w. globex

Friday, August 16, 2013

Fri. 08_16

A key for the above (5min) chart to define the horizontal lines and dots. For further explanation, see this link:

If there are arrows on the higher time frame chart (left) they indicate anticipatory trades that are entered using the faster time frame.

ES w/ globex - Closed on the lows

Thursday, August 15, 2013

thu. 08_15

A key for the above (5-min) chart to define the horizontal lines and dots. For further explanation, see this link:

ES globex

Arrows on higher time frame indicate anticipatory trades that are entered using the faster time frame.

ES globex

gold

an update on Gold as per a twitter request.

Monthly; It's funny to hear people claiming Gold to be in a bear market if your time frame is based on this chart. True the downside momentum was strong (and has potential to slow upside movement), but you can't really say that the "trend" is no longer bullish.

The $1000/oz level still looks like it would be decent support and one lower high in the grand scale of many higher lows is not necessarily bearish. Under $800/oz would get me to change my tone on this time frame. But let's face it, how many people use a monthly chart as their time frame? (OK, I did use the monthly time frame, but only because I owned physical going back a ways, and I did lighten my holdings when the 1560s gave way).

It's hard to say whether or not the "bottom is in" based on this chart, at this point in time, alone. It would be nice to see price return back above the 50-period SMA on this chart and stabilize from the previous momentum. $1389 area is the first supply pivot on this time frame and as of yet there is no structural low to cue off of

Weekly: This is likely where the "Gold-is-in-a-bear-market" argument comes from. The 20- & 50MA's have a bearish orientation and after swallowing so much momentum, price needs time to digest. We got our first mean reverting move today in the form of price coming back into the 20-period SMA.

$1390 appears to be the next pivot on this time frame, and it's interesting how symmetrical each regular/inverted cycle has been (currently in week 4 of this inverted cycle). Also, at this point, I would add a support pivot below around 1313.50.

Daily; It's encouraging (for a bull) to see the 20- & 50-day MA crossing here and to have price above both, we haven't seen that since October of last year. That could cue buyers to dabble in dip-buying behavior. We have nearly filled a gap left from June 19th and cleared a reasonably significant supply pivot (1350). Overhead we're approaching a price acceptance area and though the 1390 pivot is prevalent, the 1413-1425 pivot seem to stand out.

In the end, there's never any telling what price may do exactly. All you can really do, in my opinion, is go from pivot to pivot (whether overhead or underneath) and watch how each one is tested (rejected or accepted) depending on your overall time-frame objective (are you interested in trading the monthly, weekly, or daily time frame?).

So, for instance, using the daily chart above, the supply released into the market on June 20 (1350) was tested a month later and rejected (strong red candle). Buyers then found value under $1300 to take us back above that previous 1350 pivot. It's important we see follow-through as we move higher to test previous supply areas. The next 'lower high' pivot to take on is 1413, followed by 1470s. I suspect buyers may be timid given the higher time frame selling momentum that has taken place over the past few months, so it's baby-steps while taking cues from momentum when and where we get it. Reclaiming 1560 could be a game changer in my opinion, but first we deal with the more immediate pivots.

If you have a more specific question let me know.

Wednesday, August 14, 2013

another look

Should we open lower tomorrow; thinking selling brings us in to $168, if that gives we have some clear air until $167. Maybe looking at a trend day.

Invalidated should we open over/around $169.60.

This week's Open was $168.46, maybe we open around there tomorrow morning and see the selling try for a red closing week. So maybe we get a test to see how serious the momentum gets.

Invalidated should we open over/around $169.60.

This week's Open was $168.46, maybe we open around there tomorrow morning and see the selling try for a red closing week. So maybe we get a test to see how serious the momentum gets.

A key for the above (5-min) chart to define the horizontal lines and dots. For further explanation, see this link:

ES globex

Essentially looking to sell a failure of $168.50. A buying setup can occur should the "C" time frame show a positive fast line change, otherwise it looks weak.

Arrows on higher time frame indicate anticipatory trades that are entered using the faster time frame.

ES globex

Essentially looking to sell a failure of $168.50. A buying setup can occur should the "C" time frame show a positive fast line change, otherwise it looks weak.

Tuesday, August 13, 2013

Tue. 08_13

A key for the above (5-min) chart to define the horizontal lines and dots. For further explanation, see this link:

ES

Still unresolved range, but interesting developments. The 3d criteria setup on "C" (triggered around 11am off of "D"), also the Fast Line turning positive on "B". So, looking for a breakout higher (over $170).

Arrows on higher time frame indicate anticipatory trades that are entered using the faster time frame.

ES

Still unresolved range, but interesting developments. The 3d criteria setup on "C" (triggered around 11am off of "D"), also the Fast Line turning positive on "B". So, looking for a breakout higher (over $170).

Monday, August 12, 2013

Mon 08_12

A key for the above (5-min) chart to define the horizontal lines and dots. For further explanation, see this link:

ES w/ globex

Still no resolution, still range-bound 4-days left in OpEx week...

Arrows on higher time frame indicate anticipatory trades that are entered using the faster time frame.

Still no resolution, still range-bound 4-days left in OpEx week...

Subscribe to:

Comments (Atom)